MercoPress. South Atlantic News Agency

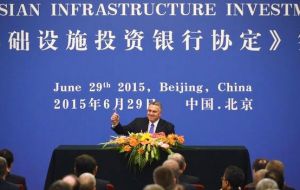

China's 'World Bank' takes off at ceremony with delegates from 50 countries

UK, Germany, Australia and South Korea are among the founding members. Japan and US, which oppose AIIB, are the most prominent countries not to join.

UK, Germany, Australia and South Korea are among the founding members. Japan and US, which oppose AIIB, are the most prominent countries not to join.  The AIIB will begin with authorized capital of $50bn, eventually to be raised to $100bn. China will hold a 30.34% stake making it the largest shareholder

The AIIB will begin with authorized capital of $50bn, eventually to be raised to $100bn. China will hold a 30.34% stake making it the largest shareholder  India will be the second-biggest shareholder with a possible 10-15% stake, while Russia and Germany will make up the third and fourth biggest member stakes

India will be the second-biggest shareholder with a possible 10-15% stake, while Russia and Germany will make up the third and fourth biggest member stakes China has hosted the signing ceremony of the Asian Infrastructure Investment Bank (AIIB), a new international financial institution set to rival the World Bank and Asian Development Bank. Delegates from 50 countries signed articles that determine each member's share and the bank's initial capital.

The UK, Germany, Australia and South Korea are among the founding members. Japan and the US, which oppose the AIIB, are the most prominent countries not to join.

The US has questioned the governance standards at the new institution, which it sees as spreading Chinese “soft power”, and tried to persuade others to stay away.

The AIIB, which was created in October by 21 countries, led by China, will fund Asian energy, transport and infrastructure projects.

Country delegates gathered at Beijing's Great Hall of the People for the signing ceremony.

Australia was the first country to sign the articles of association creating the AIIB's legal framework, followed by 49 other members. Seven more countries are due to sign by the end of the year.

Most Asian countries and countries from the Middle East and Latin America have joined, with the launch of the Beijing-led bank being hailed as a diplomatic and strategic success for China.

It is one of several institutions China has created to push its own economic agenda, largely driven by frustration over its lack of influence in the big global financial institutions such as the World Bank.

The AIIB will begin with authorized capital of $50bn, eventually to be raised to $100bn. China will hold a 30.34% stake making it the largest shareholder of the bank, according to China's Finance Ministry. This would give China 26.06% of the voting rights within the multilateral institution.

India will be the second-biggest shareholder with a possible 10-15% stake, while Russia and Germany will make up the third and fourth biggest member stakes, Reuters news agency reports.

Chinese Finance Minister Lou Jiwei said on Monday he was confident the AIIB could start functioning before the end of the year.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsI believe Australia is the 6th largest contributor.

Jun 30th, 2015 - 07:32 am 0Initial tests on their systems are looking good I hear, Argentina was brought in to smoke test the bad debtor algorithms and claw back workflow. A loan of the equivalent of USD 100 was made, and already a junior operator in the credit risk department has scanned in 2 IOUs and attached a pdf of letter denouncing their final demand as an attack on Argentina 's sovereignty.

Jun 30th, 2015 - 07:33 am 0“The use case worked beautifully” commented project manager Ivor Bik-wan. “the funniest thing was that we didn't actually lend them the money, it was a test trade out of our UAT system”.

Brazil is the ninth. Ahead of England.

Jun 30th, 2015 - 10:36 am 0https://en.wikipedia.org/wiki/Asian_Infrastructure_Investment_Bank

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!