MercoPress. South Atlantic News Agency

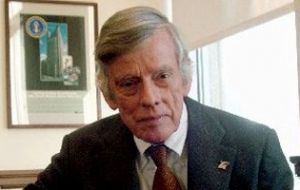

Judge Griesa looking into latest announcements by president Cristina Fernandez

A Thursday hearing with solicitors from both litigants was suspended by the US judge

A Thursday hearing with solicitors from both litigants was suspended by the US judge A court hearing in New York scheduled for Thursday midday between hedge funds holders of Argentine defaulted bond and lawyers for the Argentine government was called off on request from the holdouts.

Allegedly Paul Singer’s hedge fund NML filed a request for a hearing with Federal Judge Thomas Griesa to determine whether Argentina has violated the court’s ruling after having announced it was changing legislation and place of payment for the restructured bonds, which was seen as a mechanism to elude the ruling which favoured holdouts and was reaffirmed last week by an Appeals court.

Last Tuesday Argentine president Cristina Fernandez announced on national television that she was sending a bill to Congress to reopen the debt swap and at the same time make a new issue of the restructured bonds, which would be paid cash in dollars but in Argentina and ruled by Argentine law, in a move that aims to prevent possible embargos.

She also asked “God to illuminate the US Supreme Court” since Argentina is hoping that the case reaches the highest court and rejects Thomas Griesa ruling confirmed by an Appeals court.

On Wednesday Argentine Economy minister Hernan Lorenzino and Deputy minister Axel Kicillof went to the Senate to explain the new bond swap and other conditions, which after some heated exchanges about President Cristina Fernandez administration ‘arrogance’ towards the US court and the local opposition, it was finally supported.

The opening of a new possibility of debt swap means the pending bond holders (7%) if they accept (which they haven’t in the past), will then enjoy the same conditions as the rest of restructured bonds holders (93%).

The bill with a favourable report from Senate joint-committees now faces the full house debate next Wednesday but it is understood it will be approved since government and most of the opposition support the initiative

During the discussion with the Senate committees Minister Lorenzino reiterated that Argentina has no intention of evading or eluding US Justice. But reiterated that the Argentine government has no intention of paying the NML Capital Ltd. and other plaintiffs beforehand, but will do everything it can to ensure timely payments to the other 93%.

‘‘Argentina will pay,’’ Lorenzino said. ‘‘We ask the courts of the United States to let us pay the restructured bonds, but if they obligate us so that the money that enters has to go first to the ‘vulture funds’, then we won’t be able to pay the rest. This isn’t rebellion; it’s common sense.’’

Lorenzino also told senators that the third debt swap (previous were in 2005 and 2010) would offer the same terms as the earlier ones. This time, however, the arrangement would avoid any banks or conditions subject to US law. The new bonds would be paid by Argentina’s Banco Nacion using foreign reserves held by its Central Bank.

Judge Griesa ruled last year that whenever Argentina tries to make payments on the earlier restructured bonds through the Bank of New York, U.S. financial entities must first make sure that the plaintiffs have already been paid an equal amount in cash. His decision was upheld last week by the federal appeals court in lower Manhattan.

This would mean paying the full face value of the bonds plus interests, (in this demand 1.3bn dollar) compared to the restructured bonds that suffered an almost 65% ‘shave’. The next such payment is due on Sept. 30.

Nevertheless the US financial media said that Argentina ‘could be in trouble’ since the latest announcements from President Cristina Fernandez could be infringing terms of his early ruling

On Thursday when Judge Griesa adjourned the hearing on whether that move violates his order to avoid moves that affect bondholders’ interests, Court spokeswoman Stephanie Cirkovich said a new date for the hearing has not been set.

Top Comments

Disclaimer & comment rules-

-

-

Read all commentsIf you write a bond issue under U,S. law (to con buyers) that is the law you must obey,you gave up sovereignty when you did that

Aug 30th, 2013 - 03:02 am 0stop whingeing!

Would have to be a brave bond holder that moved their agreement solely to Argentinean jurisdiction.

Aug 30th, 2013 - 03:16 am 0(2) Anglo

Aug 30th, 2013 - 03:24 am 0I don't think you understand. They have been moved. That's the way these rg runts work!

Commenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!